For the tax year 2020-2021, the government plan to cut BIK (Benefit In Kind) tax rates for zero-emissions company cars down from 16% to 2%. As a result, electric vehicles may be a cheaper option for directors and employees.

Overview

Company car tax was reformed in April 2002 to an emissions-based system. This was to encourage businesses to choose more fuel-efficient cars in return for greater tax relief.

As a general rule, the greater the vehicle’s CO2 emissions, the greater the taxation. This means that electric vehicles and hybrid cars will attract less tax than petrol or diesel cars.

The New Rates

For the current financial year 2019-2020, the BiK rate for zero-emission vehicles is 16%.

However, the government has announced that it will cut BiK rates for zero-emissions vehicles down to 2%.

This could save employees and business owners thousands of pounds in tax each year; making environmentally-friendly cars an appealing option.

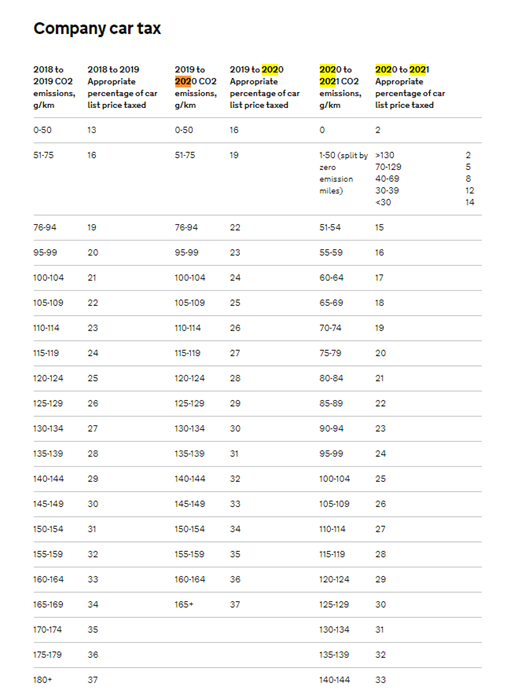

The table below shows the new Benefit in Kind bands and rates for tax year 2020 to 2021.

So how exactly does company car tax work?

Company car tax applies to cars bought by employers for their employees’ private use. The tax does not apply to a vehicle owned by a company that is used solely for business use.

Company car tax is different and more complicated than Vehicle Excise Duty (Vehicle Tax).

Essentially, company car tax is made up of two parts:

- What tax the company has to pay

- What tax the employee using the car has to pay

How much the company pays is determined by the car’s P11D value and its CO2 emissions.

The P11D value is the value of the car including VAT, accessories/add-ons and the delivery fee. The company must fill out a P11D form each year and pay a certain fee to the Treasury in National Insurance Contributions.

The employee on the other hand, will pay BiK (Benefit in Kind) tax on the car. The BiK tax rate is determined by three factors:

- The BiK tax band the vehicle sits in

- P11D value

- Your income tax bracket

Example:

Let’s say that you buy a car that has a P11D value of 30,000 and the BiK band has been set at 16%.

This means the BiK value is 30,000 x 0.16 = £4,800.

The next step is to work out how much tax you will pay on the BiK value by multiplying it by your income-tax bracket.

If you are a 20% taxpayer, you’ll pay 20% of the BiK value – which equates to £960 a year.

If you are a 40% taxpayer, it will cost you £1,920.

2020-2021 Electric Car Example:

If your electric vehicle fell into the 2% BiK band rate during the tax year 2020-2021, you would theoretically pay £120 a year in BiK for the same car used the in the above example.

BiK Value: 30,000 x 0.02 (2%) = £600

How much you pay: 600 X 0.2 (20% tax payer bracket) = £120 a year.

OR: 600 x 0.4 (40% tax payer bracket) = £240 a year.

Final Note

Please note that this is not an exhaustive explanation of company car tax, but a general overview. Please also be aware that government policy regarding electric company cars beyond 2021 remains uncertain.